|

|

Lend Smarter. Catch Fraud Faster. Meet the Modern Borrower.

|

|

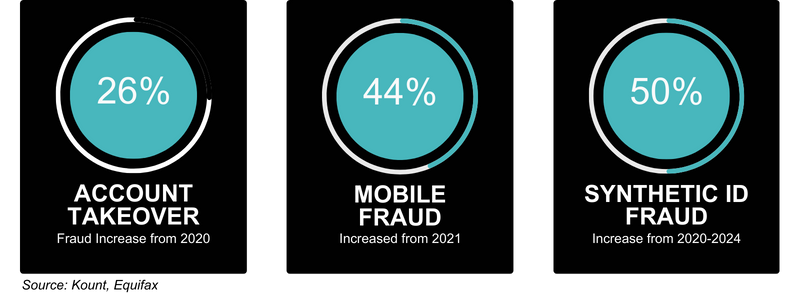

Fraud has quickly evolved from being a mere risk to becoming a common trend that demands our immediate attention. As revealed by Equifax's latest insights, the methods and strategies behind borrower applications are more complex than ever.

At LendSuite Conference 2025, Equifax delivered a mic-drop moment:

|

|

"Consumers are changing how they spend, save and borrow." – Anna Fisher, VP of Alternative Finance, Equifax

|

|

|

|

Watch the Equifax data session from the LendSuite Conference 25 to empower your strategies and outsmart fraud in the modern lending world.

|

|

|

|

|

|

If that doesn't shake you, this might: |

|

Auto Fraud is up 60% YoY, and this number is likely to increase. |

|

Savings rates across the US are at some of the lowest levels since 2008. |

|

11% of US borrowers only make minimum payments. |

|

|

|

|

|

Borrowers aren't who they used to be. Some Thrive. Many Survive. |

|

Most look stable on paper - but

their spending is fueled by buy-now-pay-later, credit cycles or evaporating

savings. Lenders who rely on outdated

assumptions are bleeding approvals, missing opportunities or worse - missing

the fraud.

|

|

Here's Where Short-Term Lenders Are Missing the Mark |

|

Assuming Self-Reported Income is Enough

→ Get context. Fast. Income ≠ capacity.

|

|

|

|

Ignoring Payment Hierarchy → If you're not first on their bill list, you’re likely last.

|

|

|

|

Treating Prime Scores Like Prime Borrowers → Many prime-score borrowers don’t behave like it anymore.

|

|

|

|

|

|

|

|

|

|

35% of alt-finance borrowers have prime or super-prime credit scores. |

They're freelancers, gig workers, renters, and digital-first decision-makers. |

|

|

|

They’ll borrow from lenders who get them. Will that be you?

|

|

|

|

|

|

|

|

|

|

Understand

Real Borrower Behavior

|

|

Move

with Speed & Confidence

|

|

|

|

Powered by data. Integrated for

speed. Built for lenders.

|

|

Don't Miss the Insights that are Shaping the Industry |

|

|

|

|

|

|

|

|

|

Why Thousands of Lenders Trust the LendSuite Newsletter This isn’t just another industry newsletter - it’s your competitive edge.

|

|

Every month, LendSuite delivers: - Proven marketing strategies for lead gen & conversion

- Fraud trends and compliance guidance, simplified

- Honest tool and software reviews (non-compete only)

- Downloadable templates, checklists, and scripts

- Exclusive lender data from our ecosystem (Infinity, EPIC, Tekambi)

|

|

Stay Smart. Stay Fast. Stay in the Know. The All-New LendSuite Newsletter |

|

|

|

|

|

The #1 Resource Short-Term Lenders Whether you need borrower analytics, marketing playbooks or fraud prevention know-how—LendSuiteSoftware.com brings it all together in one place for the modern lender.

|

|

|

|

|

|

.png)

.png)

.png)