Fraud Defense (Hero Section)

Why Fraud is a Different Beast

Prime-score profiles + subprime behaviors = red flag

Bots that spoof device fingerprints across multiple lenders

IP clusters submitting “near-match” borrower data

Fraud attempts up 51% year-over-year across the LendSuite network

What is Inside our Toolkit

Real-Time Fraud Scoring Signals from Tekambi

Stay ahead of fraudsters with instant risk assessments powered by enriched data and predictive analytics built for subprime portfolios.

Payment Hierarchy Data for Deeper Insights

Unlock the borrower’s true creditworthiness by analyzing how they prioritize payments across obligations—beyond just credit scores.

Mobile Device History Graphing

Detect suspicious behavior with device-level timelines that track historical usage patterns and uncover inconsistencies.

How to Layer Behavioral + Application-Level Flags

Improve accuracy in underwriting by combining real-time behavior cues with application anomalies to flag risky leads before funding.

Get the 2025 Fraud Toolkit

Form Goes here

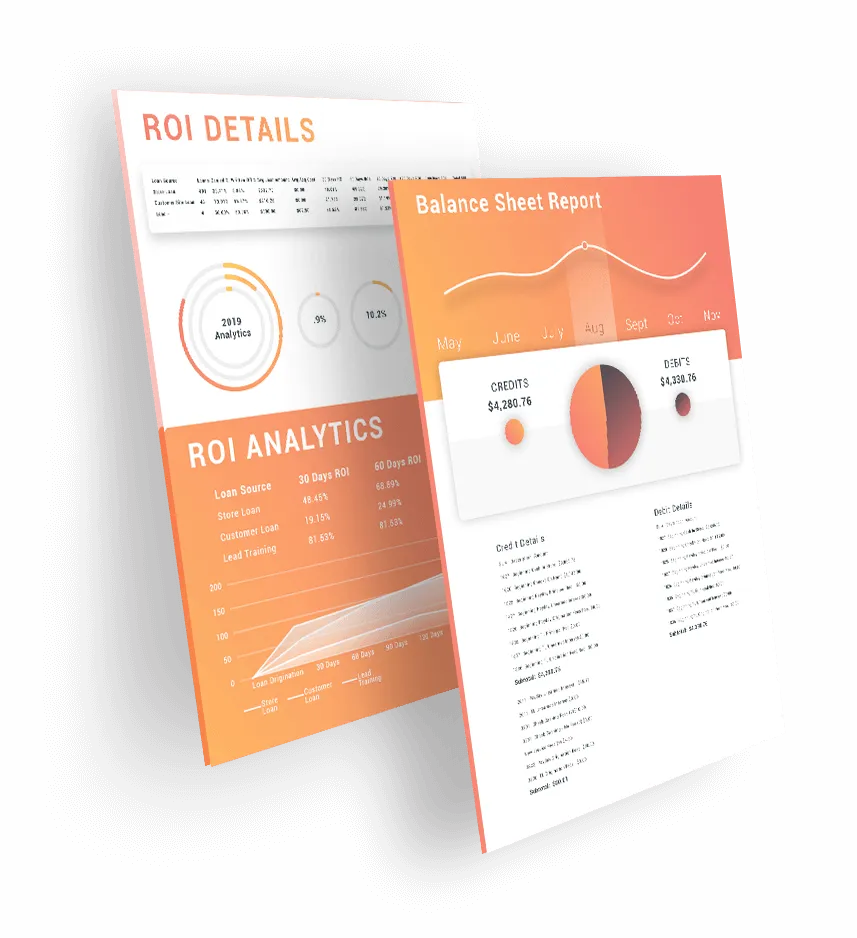

Graphic of Toolkit here

Learn the strategies top lenders are using to acquire high-quality borrowers at scale.

LSC25 RECAP

Economic Outlook & Fraud Insights w/ Equifax

Fraud has quickly evolved from being a mere risk to becoming a common trend that demands our immediate attention. As revealed by Equifax's latest insights at our LendSuite Conference 25, the methods and strategies behind borrower applications are more complex than ever.

"Consumers are changing how they spend, save and borrow."

– Anna Fisher, VP of Alternative Finance, Equifax

Watch the Equifax data session from the LendSuite Conference 25 to empower your strategies and outsmart fraud in the modern lending world.

Trusted by Lenders NATIONWIDE

"We flagged 93 synthetic profiles in one week—before funding."

Company Name

Location? Title?

“Fraud loss dropped 38% after implementing layered scoring.”

Company Name

Location? Title?

Why LendSuite Tools are Different

Infinity (workflow + alerts)

Tekambi (decisioning + fraud scoring)

EPIC (data orchestration + compliance workflows)

Powered by the Leaders in Lending Technology

When you partner with LendSuite Software, you tap into the ultimate lending ecosystem:

Contact Info

Sales: +1 (954) 678-4600

Leadership@lendsuitesoftware.com

1200 SW 145th Ave

Suite 310

Pembroke Pines, FL. 33027

USA

Site Links

Sister Links

Follow Us

©2025 LendSuite Software | An Aquila Software Portfolio | All Rights Reserved